Lbo Walkthrough

Lbo walkthrough - Follow This Guide to Crush Private Equity Paper LBO. This LBO Modeling Course is a bundle of 4 courses with 12 hours of HD video tutorials and Lifetime Access. A LifeSize virtual courtroom has been created for each District Office to function as a walk-through courtroom. The LBO model or LBO valuation model is a method for factoring in the companys capital structure and other parameters when determining the return on equity a private equity firm can expect from an LBO transaction. Limbo is a beautifully dark platform puzzler with a very unique style and weve got a guide to help you breeze through the game and find allten collectable achievements along the way. In this LBO Model tutorial youll learn how to build a very simple LBO model on paper that you can use to answer quick questions in PE and other intervi. The core drivers of value creation in an LBO are Purchase Price Cash Flow and EBITDA Expansion. Walk me through an LBO analysis. LBO Modeling. Learn to make a professional Leveraged Buyout Model from scratch.

Basics Of An Lbo Model Street Of Walls

The math works because leverage amplifies returns. Uses reflects the amount of money required to effectuate the transaction including the equity. This is an industry standard and its usually asked early in the process to weed out candidates.

Show ImageBasics Of An Lbo Model Street Of Walls

What is the purchase price and how will the deal be financed. This LBO Modeling Course is a bundle of 4 courses with 12 hours of HD video tutorials and Lifetime Access. Step 1 - Enter Deal Value.

Show ImagePaper Lbo Model Example Street Of Walls

In this LBO Model tutorial youll learn how to build a very simple LBO model on paper that you can use to answer quick questions in PE and other intervi. In simpler terms it means you are purchasing a company partially funded with debt. Led by PE Professionals This course is NOT an academic exercise.

Show ImageLeveraged Buyout Analysis Street Of Walls

First we need to make some transaction assumptions. Unlike many other approaches used in corporate finance the model is not used to determine the value of a company. Interview Question - Leveraged Buyout Walkthrough.

Show ImageLeveraged Buyout Analysis Street Of Walls

Basic LBO Modeling Test Youre given a laptop simple instructions and 30 minutes this serves as a slightly more robust early-round screen than the Paper LBO. LBO Modeling. This is the most common LBO Modeling Test given at lower-middle market and middle-market PE firms.

Show ImageLbo Model Overview Example And Screenshots Of An Lbo Model

Problem Set 1 Standard. In this LBO Model tutorial youll learn how to build a very simple LBO model on paper that you can use to answer quick questions in PE and other intervi. Standard LBO Modeling Test Youre given a laptop and 1-2 hours.

Show ImageLbo Modeling Guide And Steps To Build An Insightful Lbo Model

The company has a Year 0 revenue of 500 growing at a rate of 10 every year. Leveraged Buyout Walkthrough A leveraged buyout means that you are using leverage to buy out a company. A sample LBO model given to candidates during interviews can be used to test on a variety of issues.

Show ImagePrivate Equity Paper Lbo Step By Step Walkthrough 10x Ebitda

The company has a Year 0 revenue of 500 growing at a rate of 10 every year. Learn to make a professional Leveraged Buyout Model from scratch. In this LBO Model tutorial youll learn how to build a very simple LBO model on paper that you can use to answer quick questions in PE and other intervi.

Show ImageHow To Build An Lbo Model 7 Steps With Example Lbo Model

The company has a Year 0 revenue of 500 growing at a rate of 10 every year. The core drivers of value creation in an LBO are Purchase Price Cash Flow and EBITDA Expansion. In this module there are 16 video lessons that teach arguably the most important part of an LBO.

Show ImageLbo Model Tutorial Full Dell Case Study With Templates Part 1 Youtube

In simpler terms it means you are purchasing a company partially funded with debt. See picture here for help if needed. LBO Model Walkthrough In a leveraged buyout a PE firm acquires a company using a combination of Debt and Equity operates it for several years and then sells it.

Show ImageWhat is the purchase price and how will the deal be financed. Along with this professionally made training program you get verifiable certificates for each of the 4 courses on LBO Modeling. In this module there are 16 video lessons that teach arguably the most important part of an LBO. Led by PE Professionals This course is NOT an academic exercise. In simpler terms it means you are purchasing a company partially funded with debt. Follow This Guide to Crush Private Equity Paper LBO. If youre recruiting for the pre-MBA private equity associate role you will probably be asked to complete a paper LBO in the interview process. LBO Leveraged Buyout analysis helps in determining the maximum value that a financial buyer could pay for the target company and the amount of debt that needs to be raised along with financial considerations like the present and future free cash flows of the target company equity investors required hurdle rates and interest rates financing structure and. This is a very common interview question especially within private equity interviews. This is an industry standard and its usually asked early in the process to weed out candidates.

Leveraged Buyout Walkthrough A leveraged buyout means that you are using leverage to buy out a company. Interview Question - Leveraged Buyout Walkthrough. Uses reflects the amount of money required to effectuate the transaction including the equity. The company has a Year 0 revenue of 500 growing at a rate of 10 every year. Paper LBO Problem Sets. It is answered in detail in our WSO Private Equity interview guide. Problem Set 1 Standard. Basic LBO Modeling Test Youre given a laptop simple instructions and 30 minutes this serves as a slightly more robust early-round screen than the Paper LBO. First we need to make some transaction assumptions. This module provides a walkthrough on how to build a debt schedule in excel and also includes a variety of topics such as calculation of cash flow available for debt service revolver schedule subordinated debt schedule credit metrics and so on.

This LBO Modeling Course is a bundle of 4 courses with 12 hours of HD video tutorials and Lifetime Access. Step 1 - Enter Deal Value. A typical progression for LBO models might be as follows. The LBO model or LBO valuation model is a method for factoring in the companys capital structure and other parameters when determining the return on equity a private equity firm can expect from an LBO transaction. Walk me through an LBO analysis. With this information we can create a table of Sources and Uses where Sources equals Uses. Generally speaking notes and mezzanine debt can have PIK interest. In this LBO Model tutorial youll learn how to build a very simple LBO model on paper that you can use to answer quick questions in PE and other intervi. Limbo is a beautifully dark platform puzzler with a very unique style and weve got a guide to help you breeze through the game and find allten collectable achievements along the way. A LifeSize virtual courtroom has been created for each District Office to function as a walk-through courtroom.

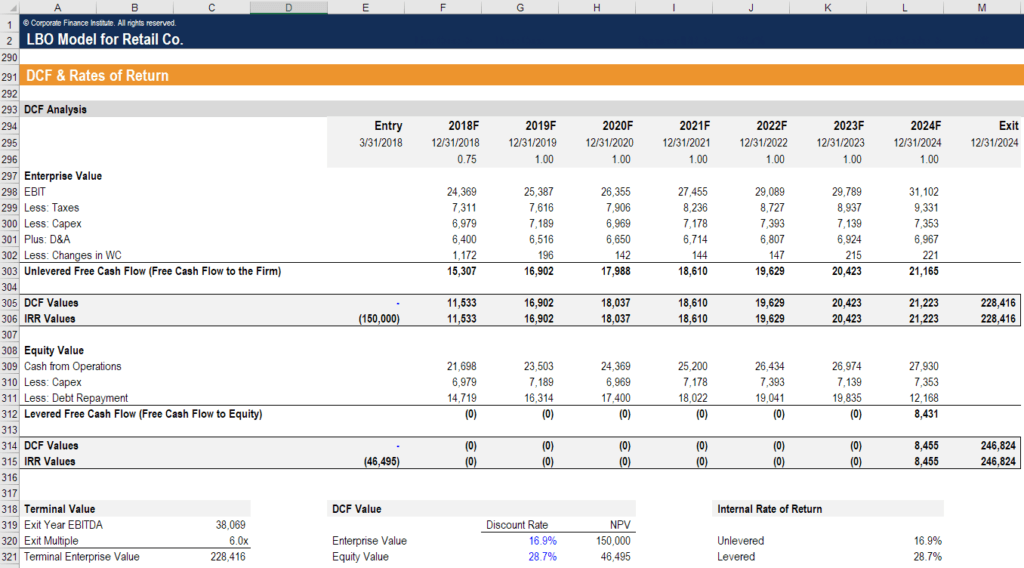

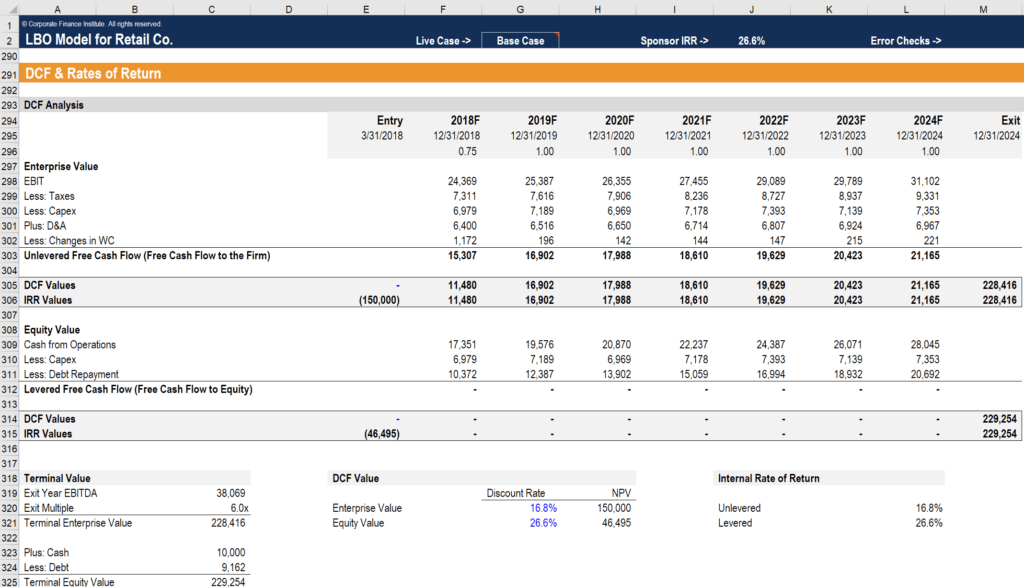

Unlike many other approaches used in corporate finance the model is not used to determine the value of a company. Were buying it at the end of Year 0 at 10x LTM EBITDA multiple. Learn to make a professional Leveraged Buyout Model from scratch. The math works because leverage amplifies returns. LBO Model Walkthrough In a leveraged buyout a PE firm acquires a company using a combination of Debt and Equity operates it for several years and then sells it. Walk Me Through an LBO and Walk Me Through an LBO Model are effectively the same question. The LBO investor would be counting on paying down more senior tranches of debt alleviating some of the interest expense before the PIK interest flips back to cash payment. Standard LBO Modeling Test Youre given a laptop and 1-2 hours. Determining a fair valuation for a company including an ability-to-pay analysis Determining the equity returns through IRR calculations that can be achieved if a company is taken private grown and ultimately sold or taken public. See picture here for help if needed.

At a high level there are 5 steps to an LBO. EBITDA margin is 20 in Year 0 and remains constant throughout the holding period. It can be switched on under Excel options formulas then check the box Enable iterative calculations. This is the most common LBO Modeling Test given at lower-middle market and middle-market PE firms. Sneak peek of the LBO model click to enlarge screenshots You need to activate iterations in Excel for this LBO model to work properly. The core drivers of value creation in an LBO are Purchase Price Cash Flow and EBITDA Expansion. This is an aggressive riskier technique. Private Equity firms pursue LBO transactions in which they use Debt to amplify the returns they can generate for their investors. LBO Modeling. A sample LBO model given to candidates during interviews can be used to test on a variety of issues.